Are you crazy? No Malay people will eat burger like all those foreigner. Why you want to start this business?

Gold investment has become one of hot option in this last 10 years. Basically, investing in gold is by purchasing gold in form of bar, coin or just a paper(paper gold investment will be review in next post).

People tend to see investing in gold is promising high return by times. They keep on thinking that gold price will always hiking up and by times also they can covered up their investment cost. But do you know what will the gold investment charged you hideously?

Jeff Reeves in one of his article written in here is sharing what other gold investment hidden cost that you will have to take.

Five Hidden Costs of Gold

Commentary: Investing in gold isn't as easy as it looks

There's a lot of talk right now about how gold is booming, and how gold bugs who have been stashing bullion under their mattresses over the last decade or so have made a killing.

That may be true if you look at the price of the yellow stuff per ounce. The price of an ounce of gold is up about 30% in the last year, or over 400% in the last 10 years. How does that relate to actual returns for investors?

The truth is that gold has steep hidden costs, and that looking at the numbers on paper doesn't tell the whole story. Here are big costs many investors overlook.

Higher taxes

The affinity for gold investing and a dislike of the government seem to go hand in hand, from predictions that massive government debt will render the dollar worthless to conspiracy theories that there will be another Executive Order 6102 in which Uncle Sam loots your safe deposit box and seizes your gold.

But the biggest reason for gold investors to get mad at the feds is their tax bracket. The IRS taxes precious metal investments — including gold ETFs like the SPDR Gold Trust (NYSE: GLD - News) and iShares Silver Trust (SLV - News) — as collectibles. That means a long-term capital gains tax of 28% compared with 15% for equities (20% if and when the Bush tax cuts expire next year).

While you may see your gold as a bunker investment, the IRS will treat you the same as if you were hoarding Hummel figurines. And that means a bigger portion of your gold profits go to the tax man.

Zero income

Just as the math game on gold price appreciation doesn't tell the whole story, the lack of regular payouts is another reason why the long-term profits quoted in gold are incomplete. Many long-term investors can't afford to stash their savings in the back yard for 20 years. Income is a very valuable feature of many investments and gold simply doesn't provide that.

Remember, simply looking at returns in a vacuum can't tell you whether an investment is "good" or "bad." Is it a good idea for a 70-year-old retiree on a fixed income to bet on penny stocks because they could generate huge profits? Even if those trades pay off, 99 out of 100 advisers would say something akin to "You got lucky this time, but don't tempt fate. Quit while you're ahead and don't be so aggressive."

Similarly, the volatile and income-starved gold market is not a place for everyone. Just because past returns for gold have been so stellar, that does not mean that gold is low risk or that investors who need a secure source of regular income will be well-served.

Gold scams take a toll

In a previous article, I detailed gold coin scams in detail. They include false gradings on the quality of the coins, the use of cheaper alloys instead of pure gold and even brazen scams where you don't actually even own the gold that you buy. And that's just on the coins front. Scams abound in pawn shops and "cash for gold" enterprises that refuse to give you a true value for your jewelry or other gold items.

You'd think it would be obvious that precious metals should never be purchased from anyone other than a broker or seller of good repute who provides proper documentations. But many investors fail to do their homework, or worse, can't tell forged documents from real ones.

Gold is ready-made to be a retail sales item, and with that comes all manner of unscrupulous activity. Vigilant investors can protect themselves, but do not underestimate the very real price of being taken to the cleaners by a gold scam if you don't do your homework.

High ownership and storage costs

Maybe through some creative accounting or selective amnesia at tax time you can mitigate the tax burden of gold. But one expense you can't as easily avoid is the high ownership cost of gold. After all, it's not like you mined it yourself — and all those middlemen between the ore and you want to get paid.

The first is that old tightwad Uncle Sam again. Even if you can avoid him going on the capital gains front, he gets you coming into gold via sales tax on most jewelry and coins. And then there are the high transaction costs and commissions that gold can carry. Anyone who has bought jewelry knows significant markups are part of the precious metals trade, and that's the same for investment gold as it is for engagement rings. The bottom line is that some of your initial buy-in goes towards the business of gold and you'll never get it back, not unlike realtor fees or broker fees.

And then there's the additional cost of storing your gold. You have to pay a fee for a safe deposit box, and if you have a lot of gold, that can run you a few hundred bucks a year for a good-sized box. Of course if you're afraid of that Order 6102 scam pulled by FDR you likely have your gold at home in a safe — so that's a one-shot deal. But are you really foolish enough to distrust the government but trust your gold stash to be safe without insurance?

The presumed "safety" of gold is good on paper, but obtaining the actual metal and keeping it safely stored is a costly endeavor.

Yes, gold can lose value

Proponents of gold love to claim that gold has never been worthless like Lehman Bros. or GM. And while this is true on its face, it is actually a half-truth. While gold may never become worthless, it is foolish to think it will never lose value.

Consider that after reaching a record high of $850 per ounce in early 1980, gold plummeted 40% in two months. The average price for gold in 1981 fell to a mere $460 an ounce — and continued nearly unabated until bottoming with an average price of around $280 in 2000. For those folks in their 40s and 50s who bought gold at that 1980 high, it took them 28 years to reclaim the $850 level. That's hardly much of a retirement plan, unless they lived to be 80 or 90 and just cashed out recently.

Gold is an investment, period. And no matter how gold bugs spin the metal as a hedge against inflation and a sure thing that will only go up, gold can lose its value — sometimes in a hurry, as in the early 1980s.

Financial Freedom: Quotes of The Day

9/26/2010 12:58:00 AM

|

Financial Freedom,

Financial Quotes

|

0

comments »

9/26/2010 12:58:00 AM

|

Financial Freedom,

Financial Quotes

|

0

comments »

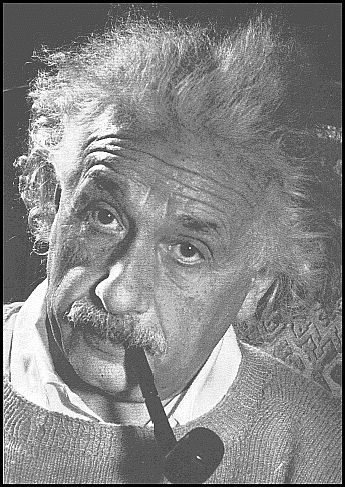

"Beware of geeks bearing formulas."

"Derivatives are financial weapons of mass destruction."

"I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years. "

"If a business does well, the stock eventually follows."

"It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you'll do things differently."

Warren Buffett

Investment Tips: Why you should avoiding MLM

9/26/2010 12:28:00 AM

|

Financial Freedom,

Info,

Investment,

Pyramid Scheme,

Tips

|

0

comments »

9/26/2010 12:28:00 AM

|

Financial Freedom,

Info,

Investment,

Pyramid Scheme,

Tips

|

0

comments »

Previously, Financial Freedomino has posted an article regarding MLM scheme.

The MLM scheme are now evolving. The conventional one are known for selling ones product, by promoting someone to join and sit under the promoter tree in the scheme and keep on eating the commissions from future promoted person.

In Malaysia, the typical MLM recruiting process are like:

- tell their close friends to come to chosen Food Stall (Normally Mamak's stall). Promised to treat their friend and when the time arrive, blah!. The promoter come but accompanied by the person that he called as Upliner.

- Suddenly receive a call from the relatives that seldom asking how well we are, asking that are we will be home in this day, and this time because wanted to have a visit. Some worst case scenario, they do have sudden visit, also by bringing along what we called as Upliner. Then, the brainwash session started.

Seriously, only these two reason can make me really hate the MLM recruiter. Actually there are other tricks & 'treats' but these two process seems the most popular one

!

As the era changed and evolved, now the MLM scheme is being implemented online. People starts to see that Internet as their gold mines. People also learn internet can help to generate extra income and cash to them. Some people claimed that they can earn $100 (hundred dollars) perday from the internet. Some company also has created their own Internet Marketing strategy and promising future hope to future members/investor if they join their scheme. Back to the basic, when it was MLM, it will always be MLM, acting like the MLM, and finally ended like other MLM too!

The article below listed some tips to avoid the MLM scheme in the internet.

What Is MLM Or Multi Level Marketing...

Ok Here We Go...

- What Is MLM Or Multi Level Marketing, Also Called "Network Marketing"

The only people who make money from Multi Level Marketing schemes are those that are high up in the pyramid and having their down line doing all the hard work for them by signing up new members, selling product and what ever it involves for them to make money. I think that if you are new to the whole concept of MLM and you don't have powerful and rich friends who are Heavily involved in MLM and have hundreds of network partners online, then the sad fact is that you will fail! 97% of MLM newbies fail, this business is by far not easy and it's not really a get rich quick scheme. This business model involves a lot of hard work and hands on selling to customers and most of all involve dealing with a product! If you don't have the talent to sell stuff to people and sign up other people for a large sign up fee then i think you will be set sailing to FAIL!

If you are new to MLM concept then steer well clear of it until you have a lot of heavy internet marketing background and marketing experience behind you, you need this to be able to sell the product or the service that you will be required to sell by the company in order to get paid!

MLM Marketing is usually reasonably expensive to get started, Usually between$250 To $1000 Just To Sign Up. As you can see it's a reasonable investment on your behalf and there is Absolutely NO GUARANTEE that you will make money, let alone get any of your sign up fee back!

Once Again, if you are new to MLM concept and you are just starting out in marketing world then steer clear from MLM for now! It's not for you...

Another Famous Load Of Bull, Get Rich Quick Gurus!

"Look at me... Look how rich I am , I live in a million dollar house and own over a million dollars worth of cars !!! Now I Can Teach You To Do The same, because i know a secret to making money online that you don't Order my guides now for only $49.95 and you will start making thousands online using my secrets...."

Haha to that, sure they live a multi million dollar lifestyle but they didn't make it by knowing something most of us don't ! They simply got off their butts, wrote up a couple of vague money making guides that are supposed to teach you how to make money online and whatever else they promise, Build a flashy website with fancy graphics and full of Fake testimonials to convince you that their stuff works for others and write a fancy sales letter how they went from having 5 bucks in their pocket, to discovering a secret to make thousands online and becoming a millionaire online...

Whatever, the reason these guys have this money is because a lot of people are after similar lifestyle that they lead and they just wanted to get the financial freedom they deserve so this guy's website happens to pop up in the right time and YOU BUY HIS PROMISES AND HIS GUIDES!... That's how they make their millions, not by using some super dooper secret to making money online...

You think about it, if they sell 20,000 copies of their guide online which is relatively easy to achieve if your website is fancy and you are damn good at talking peoples ears off and convincing them to buy your stuff... that's A MILLION DOLLARS... That's how they make their millions!

Don't fall for these Hyped Up Worthless Systems, These will only make you a few bucks poorer and make these guys a few bucks richer!

Full post can be read here.

See, stay away from MLM!

Save your savings!

Invest in appropriate portfolio!

The Best Time To Invest Money

9/24/2010 01:20:00 AM

|

Financial Freedom,

Info,

Investment,

Mutual Fund,

Stock

|

0

comments »

9/24/2010 01:20:00 AM

|

Financial Freedom,

Info,

Investment,

Mutual Fund,

Stock

|

0

comments »

When is the best time to invest your money? How do you know it is the best time to invest your money?

This is the question that keep on lingering the future/new investor. When is the best time to invest your money?

The main objective of investing to gain more from what you have spend. By doing this, most of people will need to spend their earnings, resources for starting up their investment. Most people worked hard to earn the money, that's why we don't want to lose it anymore!

So, when is The Best Time to invest money?

This article found here could give some guide to all new investor in choosing the best time to invest money.

The Best Time to Invest Money

By James Leitz

The best time to invest your money is NOW ... if you understand diversification and dollar cost averaging. Look at it this way. If you don't invest your money, you'll either spend it or earn low interest rates as a saver.

The only way to get ahead is to learn how to invest. This is not as difficult a proposition as most folks believe it to be. Let me explain with some simple logic, in the form of a short story.

At a wedding reception in the early Spring of 2009, a young man named Cameron listened as his much-older uncles complained about their investment losses. "My broker's worthless, and I've lost half my money in stocks in the past year", stated Uncle Ron. "I'm earning less than 1% in interest", declared his conservative Uncle Jack. "My real estate investments are under water", Uncle David added.

Cameron had a thought as he vacated the circle of conversation. He applied simple logic to what he had just heard. He knew that both stock prices and real estate values usually went up. That's why most investors make money in both investment arenas.

If both real estate prices and stock prices are low, it might be a good time to invest money, Cameron reasoned. But he had a few unanswered questions on his mind. First, he did not know how to invest. Second, he didn't have a pot full of money. Finally, which was the better investment ... stocks or real estate? Obviously, no one ever gets rich earning low interest rates.

The next morning Cameron sat down for a cup of coffee with Uncle Jim, who was supposed to know all about this investment stuff. They formulated the following plan.

Cameron would open an IRA with a large no-load mutual fund company, since he wanted to invest money for retirement. He would have $400 a month flowing from his checking account to the fund company. It would be divided equally into four different mutual funds: an S&P 500 Index fund, an international stock fund, a real estate fund, and a money market fund.

This would give him diversification in both stocks and real estate. The money market fund offered a bit of safety and flexibility.

Cameron would keep the value of his four funds about equal. If the value of a fund got out of line with the others, he would transfer money from one to another to even things out. Uncle Jim called this "rebalancing" his portfolio. He would do this once a year.

Plus, he would have dollar cost averaging working for him, since he had a fixed amount of money flowing into each fund every month. If the price of a fund fell, the money flowing into it would automatically buy more of the cheaper shares. If the price rose, he would be buying fewer at the higher price.

Should the stock market and/or real estate market get real cheap, Cameron would have some powder dry to take advantage of the situation. He could move the money in his safe money market fund into the other three funds.

Now is always a good time, if you know how to invest.

Why Islamic bonds are hot these days

9/22/2010 10:30:00 PM

|

Financial Freedom,

Info,

Investment,

Sukuk

|

0

comments »

9/22/2010 10:30:00 PM

|

Financial Freedom,

Info,

Investment,

Sukuk

|

0

comments »

U.S. treasuries have rallied substantially year to date, driving down their yield to what some believe to be bubble-like levels.

Yet there's another fixed income market booming right now -- Sukuk's, or Islamic bonds. Sukuk's don't technically pay interest, they rather pay a portion of cashflow, similar to a bond yield, related to an underlying investment in order to be compliant with Islamic law.

Bloomberg:

The average yield on dollar-denominated notes that comply with religious principles from Dubai to Malaysia fell 25 basis points, or 0.25 percentage point, so far this week to 5.22 percent, the lowest level since November 2005, according to the HSBC/NASDAQ Dubai US Dollar Sukuk Index. The yield has dropped 204 basis points this year.

Note that low yields equate to high bond prices. Limited supply of new Sukuk issues has been a factor behind the latest 4-year high:

Global sales of Islamic bonds fell 25 percent to US$8.3 billion so far this year, according to data compiled by Bloomberg. A total of US$20.2 billion was sold last year. Issuance may improve in the second half, led by first-time borrowers, Standard & Poor's said in a statement on July 28.

"Flight-to-Quality"

Moreover, sovereign Islamic bonds have done even better:

Government Islamic bonds have outperformed securities sold by companies this year and the trend is likely to continue, according to Kuala Lumpur-based OSK-UOB Unit Trust. Sovereign notes returned almost 10 percent, compared with an 8 percent gain in corporate debt, the HSBC/NASDAQ Dubai US Dollar Sukuk Indexes shows.

American and European debt problems have to be playing into this as well. As the market for Islamic bonds grows, wealthy Muslim investors are likely to give sovereign 'Islam-compliant' bonds a second look, especially those backed by resource rich nations such as Saudi Arabia. In a sense, a sovereign bond backed by a nation sitting on massive natural resources is backed by commodities, such as oil in the case of Saudi Arabia. Some might prefer betting on the value of Saudi Arabia's oil holding up, rather than Uncle Sam's future deficit.

In addition, non-Muslim investors are catching wind of Sukuks' appeal. Saudi Arabia's Islamic Development Bank is planning a US$100 million Sukuk sale to South Korea soon.

Source here.

Financial Freedom: Quotes of The Day

9/21/2010 11:49:00 PM

|

Financial Freedom,

Financial Quotes

|

0

comments »

9/21/2010 11:49:00 PM

|

Financial Freedom,

Financial Quotes

|

0

comments »